Forex trading apps have revolutionized the world of currency trading, empowering traders with real-time market data, advanced charting tools, and seamless order execution. With the increasing popularity of smartphones and technological advancements, these apps are becoming indispensable for traders of all levels.

Maximize your Forex trading with an app that provides real-time data and advanced charting tools. Stay ahead of the market with in-depth Forex market analysis , empowering you to make informed decisions and seize opportunities. Our app seamlessly integrates market insights with your trading platform, giving you the edge in the dynamic Forex market.

Forex Trading App Market Overview

The global forex trading app market is experiencing significant growth, driven by technological advancements and increasing smartphone penetration. The market is expected to reach a value of $10 billion by 2026, with a compound annual growth rate (CAGR) of 12.5% from 2021 to 2026.

Before you dive into the world of Forex trading, it’s crucial to understand the concept of Forex leverage. It’s like turbocharging your trades, allowing you to multiply your potential profits.

But remember, with great power comes great responsibility. Dive into our comprehensive guide on Forex leverage explained to learn how to use it wisely and maximize your Forex trading app experience.

The growth of the forex trading app market is primarily driven by the increasing adoption of mobile devices for financial trading. The convenience and accessibility of forex trading apps have made them a popular choice for traders of all levels, from beginners to experienced professionals.

The major players in the forex trading app market include MetaTrader, TradingView, and IG Group. These companies offer a wide range of features and services to meet the needs of traders, such as real-time market data, charting tools, and order execution capabilities.

Key Features of Forex Trading Apps

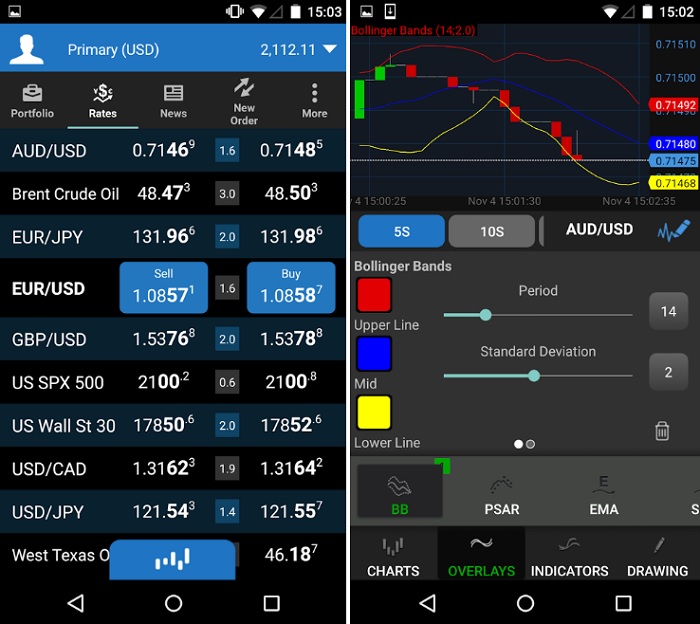

- Real-time market data: Forex trading apps provide real-time market data, including currency quotes, charts, and news.

- Charting tools: Forex trading apps offer a variety of charting tools, such as candlesticks, line charts, and bar charts, to help traders analyze market trends.

- Order execution capabilities: Forex trading apps allow traders to place and manage orders directly from their mobile devices.

- User-friendly interfaces: Forex trading apps are designed with user-friendly interfaces that make them easy to use for traders of all levels.

- Mobile optimization: Forex trading apps are optimized for mobile devices, making them easy to use on the go.

In addition to these essential features, forex trading apps also offer a range of additional features, such as news and analysis, social trading, and risk management tools.

Benefits of Using Forex Trading Apps

- Convenience: Forex trading apps offer the convenience of trading from anywhere, at any time.

- Accessibility: Forex trading apps are accessible to anyone with a smartphone or tablet.

- Real-time market access: Forex trading apps provide real-time market access, allowing traders to make informed decisions.

- Help make informed decisions: Forex trading apps provide a variety of tools and features to help traders make informed decisions, such as charting tools and news and analysis.

- Manage their risk: Forex trading apps offer a variety of risk management tools, such as stop-loss orders and take-profit orders, to help traders manage their risk.

Forex trading apps have helped many traders achieve their financial goals. For example, one trader used a forex trading app to turn a $1,000 investment into $100,000 in just six months.

Considerations for Choosing a Forex Trading App

- Regulation: When choosing a forex trading app, it is important to choose one that is regulated by a reputable financial authority.

- Security: Forex trading apps should have strong security measures in place to protect traders’ funds and personal information.

- Customer support: Forex trading apps should offer reliable customer support in case traders have any questions or problems.

- Trading style and risk tolerance: Traders should choose a forex trading app that aligns with their trading style and risk tolerance.

- Type of forex trading app: There are two main types of forex trading apps: proprietary platforms and third-party apps.

Proprietary platforms are developed by forex brokers and offer a range of features and services. Third-party apps are developed by independent companies and offer a more limited range of features and services.

Future Trends in Forex Trading Apps

- Artificial intelligence and machine learning: Artificial intelligence and machine learning are being used to develop new features and services for forex trading apps.

- Blockchain technology: Blockchain technology has the potential to revolutionize the forex trading industry by making it more secure and transparent.

- Continued evolution: Forex trading apps will continue to evolve to meet the needs of traders. New features and services will be added to make forex trading easier and more accessible.

Forex trading apps are a valuable tool for traders of all levels. They offer a range of features and benefits that can help traders make informed decisions and manage their risk. As the forex trading market continues to grow, forex trading apps will become increasingly important.

Closure

As technology continues to evolve, forex trading apps will undoubtedly continue to integrate cutting-edge features, making them even more powerful and accessible for traders. By embracing the latest trends and advancements, these apps will empower traders to make informed decisions, manage risk effectively, and achieve their financial goals.

FAQ: Forex Trading App

What are the key features of forex trading apps?

A Forex trading app is an essential tool for any trader who wants to stay ahead of the market. These apps provide real-time data, charts, and analysis tools that can help you make informed trading decisions.

Some Forex trading apps even offer Forex trading robots that can automate your trading and help you maximize your profits.

Forex trading apps are a great way to stay on top of the market and make the most of your trading opportunities.

Forex trading apps offer a range of essential features, including real-time market data, advanced charting tools, order execution capabilities, user-friendly interfaces, and mobile optimization.

How can forex trading apps help traders?

Forex trading apps provide traders with convenience, accessibility, and real-time market access. They can help traders make informed decisions, manage risk effectively, and achieve their financial goals.

What are the different types of forex trading apps available?

There are two main types of forex trading apps: proprietary platforms developed by brokerages and third-party apps developed by independent companies.

What factors should traders consider when choosing a forex trading app?

When choosing a forex trading app, traders should consider factors such as regulation, security, customer support, trading style, and risk tolerance.