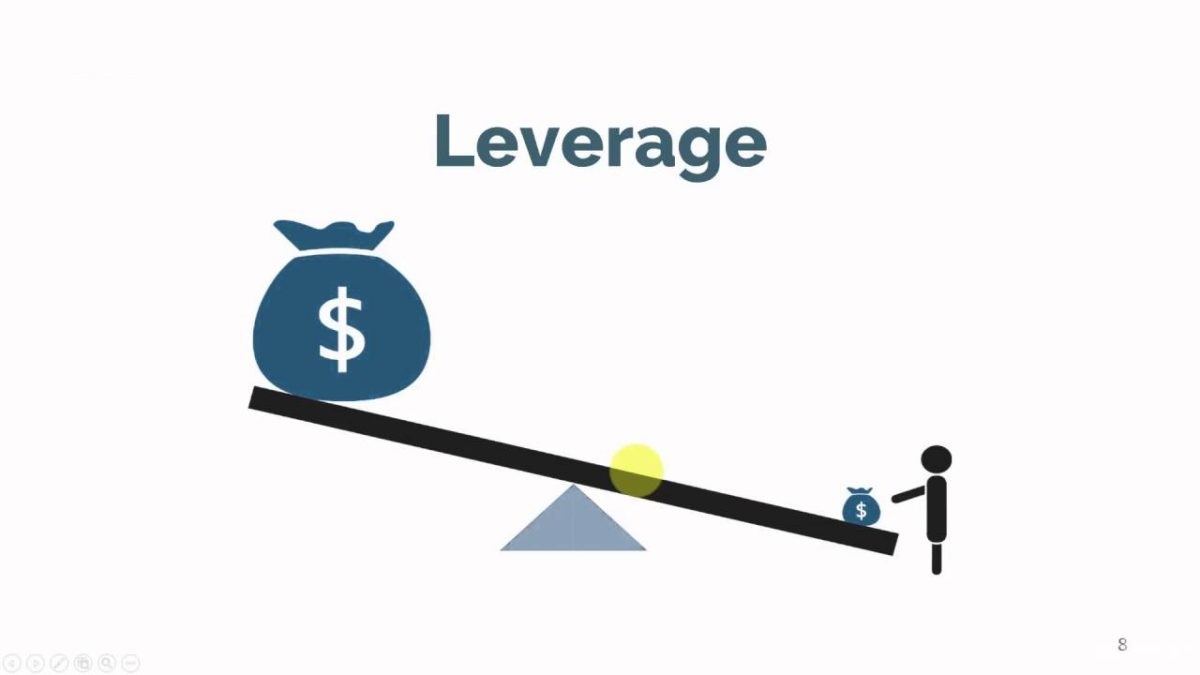

Forex leverage is a powerful financial tool that enables traders to control larger positions with a smaller amount of their own capital. It amplifies both profits and losses, making it essential for traders to understand its intricacies and manage associated risks effectively. This article dives deep into the world of Forex leverage, providing insights on how it works, how to calculate it, and strategies for managing risk. Whether you’re a novice or an experienced trader, understanding leverage is crucial to your success in the Forex market.

Table of Contents

ToggleUnderstanding Forex Leverage: Forex Leverage Explained

At its core, Forex leverage allows traders to borrow money from their broker to increase their trading position. It enables them to control a larger amount of currency than they could with their own capital alone. For instance, with a 50:1 leverage ratio, a trader with $1,000 in their account can control a position worth $50,000. This ability to magnify position size allows for potentially higher profits, but it also increases the risk of larger losses.

Leverage is particularly useful in currency trading due to the typically low volatility of currency pairs. However, it is essential to use leverage responsibly to avoid substantial losses. While leverage can significantly increase your profits, it can also wipe out your entire account if the market moves against you.

Key Benefits of Forex Leverage

- Increased Position Size: Control larger trades without needing a substantial upfront capital investment.

- Potential for Higher Profits: The amplified position size allows for greater returns if the market moves in your favor.

- Flexibility in Trading: Allows traders with smaller accounts to participate in larger market movements.

However, with these benefits come risks, as Forex leverage can turn against traders just as quickly.

Calculating Leverage: Forex Leverage Formula

Understanding how to calculate Forex leverage is a vital skill for any trader. The formula for calculating leverage in Forex trading is straightforward:

Leverage = (Position Size / Account Balance) x 100

For example, if you have an account balance of $1,000 and you open a position worth $10,000, the leverage would be 10:1. Here’s how this works:

| Account Balance | Position Size | Leverage Ratio |

|---|---|---|

| $1,000 | $10,000 | 10:1 |

| $1,000 | $50,000 | 50:1 |

| $1,000 | $100,000 | 100:1 |

In this scenario, the leverage allows the trader to control a $10,000 position with just $1,000 of their own money. While this increases the potential return on investment, it also increases the risk. The higher the leverage ratio, the higher the risk that a small price movement could lead to significant losses.

Understanding Forex leverage in depth is crucial for anyone looking to venture into leveraged trading. If you’re interested in other investment opportunities, consider exploring the Best investment apps that provide additional ways to grow your capital.

Choosing the Right Leverage: What Suits Your Trading Style?

Selecting the appropriate leverage ratio is a critical decision that depends on several factors, including your trading strategy, risk tolerance, and account size. For beginners, it is advisable to start with lower leverage ratios, such as 10:1 or 20:1, to reduce the risk of large losses. More experienced traders, who understand market volatility and have a strong risk management plan, may use higher leverage ratios like 50:1 or 100:1.

Factors to Consider When Choosing Leverage:

- Trading Strategy: Long-term traders may opt for lower leverage, while short-term traders, such as day traders, may prefer higher leverage ratios.

- Risk Tolerance: Traders with a high tolerance for risk may feel comfortable using higher leverage, while conservative traders might stick to lower ratios.

- Account Size: Smaller accounts should use lower leverage ratios to avoid the risk of losing a significant portion of their capital in one trade.

Choosing the right Forex leverage ratio is essential for maximizing profits while minimizing risk. Additionally, incorporating leverage within a broader investment portfolio can provide a balanced approach to financial growth. To understand how to create a diversified portfolio, check out our detailed guide on Investment portfolio management.

Managing Risk with Forex Leverage

One of the most critical aspects of Forex trading with leverage is risk management. Without proper measures in place, the very tool that can multiply profits can also magnify losses. Here are some effective strategies for managing risk when using Forex leverage:

1. Use Stop-Loss Orders

A stop-loss order is a pre-set order to automatically sell a position once the price reaches a certain level. This is one of the simplest and most effective ways to limit potential losses. By setting a stop-loss, you can prevent catastrophic losses if the market moves against your position.

2. Maintain a Small Account Size

Trading with a small account size in proportion to your overall financial resources can help limit the amount of money at risk. For instance, if you allocate only a small portion of your capital to leveraged trades, the potential losses from a bad trade will have a lesser impact on your overall finances.

3. Position Sizing

Choosing the correct position size is key to controlling risk. Even with high leverage, keeping your position size smaller in relation to your account balance can reduce the chance of wiping out your account during a market downturn.

4. Monitor Market Volatility

Stay updated on market trends and potential economic events that could cause volatility. Understanding when to avoid highly leveraged positions is crucial in navigating unpredictable market conditions.

Effective risk management in leveraged Forex trading requires a well-thought-out plan and discipline. If you’re interested in broadening your knowledge, consider our guide on How to make money in the stock market. Understanding both Forex leverage and stock market strategies will provide a holistic approach to investing.

Leverage in Other Markets: Diversifying with Other Investment Tools

While Forex leverage is widely used in currency trading, leverage is also available in other markets like stocks, commodities, and futures. However, the leverage ratios in these markets tend to be lower than those offered in Forex trading. Diversifying your investments by using leverage across multiple markets can potentially reduce risk and improve returns.

For example:

- Stock Market Leverage: Some brokers offer margin accounts for trading stocks with leverage, usually at lower ratios than Forex.

- Commodities and Futures Leverage: Leverage in commodities or futures can be significant but also carries higher risk due to the volatility of these markets.

Exploring leveraged trading across various asset classes can provide a broader investment strategy. Nevertheless, always ensure that you understand the specific risks involved in each market. For more information on diversified investment options, visit reputable financial sites like Investopedia .

Conclusion: The Power and Perils of Forex Leverage

In conclusion, Forex leverage is a double-edged sword. When used wisely, it can amplify profits and open doors to larger market positions. However, when misused, it can lead to devastating losses. Understanding how leverage works, how to calculate it, and implementing strong risk management strategies are essential for long-term success in the Forex market. Knowledge, discipline, and careful planning will allow you to harness the power of leverage and use it as a tool for achieving your financial goals.

FAQ Section

Q: What is leverage in Forex trading?

A: Leverage allows traders to control a larger position in the market with a smaller amount of capital, potentially magnifying profits.

Q: How do I calculate leverage?

A: Leverage is calculated by dividing the total position size by the margin required to open the position.

Q: What are the risks of using leverage?

A: Leverage can amplify both profits and losses, so it’s essential to manage risk effectively through stop-loss orders and proper position sizing.