Stock market trends, the ever-evolving landscape of the financial world, beckon us on a captivating journey. From the bustling trading floors to the intricate dance of global economies, this narrative delves into the intricacies that shape market movements, empowering investors with the knowledge to navigate the dynamic terrain.

Monitoring stock market trends is crucial for savvy investors seeking to optimize their returns. By analyzing market patterns, investors can identify potential opportunities and risks.

This knowledge can then be applied to effective investment portfolio management , where diversification and asset allocation strategies play a key role in mitigating risk and maximizing returns.

As stock market trends continue to shape the financial landscape, investors who stay informed and adapt their portfolios accordingly are more likely to achieve their long-term investment goals.

Unveiling the forces that drive stock prices, we’ll explore the interplay of macroeconomic factors, company-specific dynamics, and the art of technical analysis. Together, we’ll unravel the secrets of successful investment strategies, empowering you to make informed decisions and seize market opportunities.

Stock Market Trends

The stock market is a complex and ever-changing landscape. Understanding the factors that influence stock market trends is crucial for investors looking to make informed decisions.

This article provides a comprehensive overview of the key factors that drive stock market movements, including market overview, economic factors, company-specific factors, technical analysis, and investment strategies.

Staying abreast of stock market trends is crucial for successful investing. For beginners, it’s wise to start with Best stocks for beginners that offer stability and growth potential.

By understanding market dynamics and identifying undervalued stocks, you can make informed decisions that align with your financial goals.

By keeping an eye on market trends and researching potential investments, you can increase your chances of long-term success in the stock market.

Market Overview

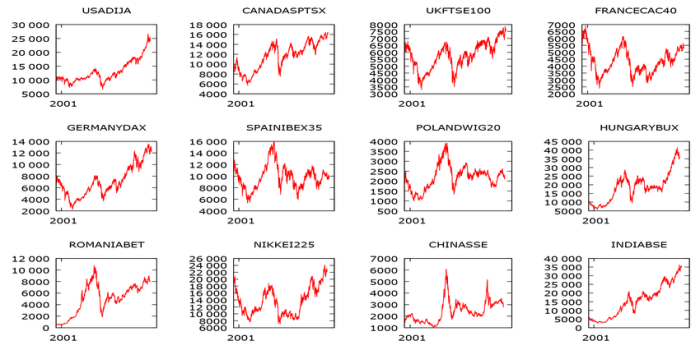

The market overview provides a snapshot of the current state of the stock market. Key market indices, such as the Dow Jones Industrial Average and the S&P 500, offer a broad view of market performance. Analyzing the performance of major industry sectors can help investors identify areas of strength and weakness.

Economic Factors

Economic factors play a significant role in shaping stock market trends. Interest rates, inflation, and GDP growth are macroeconomic factors that can impact market sentiment and investment decisions.

Monetary and fiscal policies implemented by central banks and governments can also influence market performance.

Company-Specific Factors

Company-specific factors can have a direct impact on stock prices. Evaluating financial statements, earnings reports, and analyst ratings can provide insights into a company’s financial health and growth prospects. Mergers, acquisitions, and other corporate events can also affect stock performance.

Technical Analysis

Technical analysis is a method of evaluating stock market trends by studying historical price data. Using charts, indicators, and patterns, technical analysts aim to identify potential trading opportunities and predict future price movements.

While technical analysis has limitations, it can be a useful tool for investors looking to make short-term trading decisions.

Investment Strategies, Stock market trends

Based on market trends, investors can adopt different investment strategies to achieve their financial goals. Value investing involves identifying undervalued stocks with strong fundamentals, while growth investing focuses on companies with high growth potential.

Income investing prioritizes stocks that pay regular dividends. Diversification and asset allocation are key principles for managing investment portfolios and reducing risk.

Last Recap

As we conclude our exploration of stock market trends, it becomes evident that understanding these dynamics is not merely an academic pursuit but a vital skill for navigating the ever-changing financial landscape.

By embracing the insights gleaned from this guide, investors can position themselves to capitalize on market movements, achieve their financial goals, and secure their financial futures.

Quick FAQs: Stock Market Trends

What are the key factors that influence stock market trends?

Stock market trends are influenced by a multitude of factors, including macroeconomic indicators (interest rates, inflation, GDP growth), company-specific performance (earnings, revenue growth), geopolitical events, and investor sentiment.

How can I use technical analysis to identify market trends?

Technical analysis involves studying historical price data to identify patterns and trends. By analyzing charts, indicators, and patterns, traders can make informed predictions about future price movements.

What are the different investment strategies based on market trends?

Understanding stock market trends is crucial for successful investing. Seasoned investors often employ Day trading strategies to capitalize on short-term market fluctuations.

By studying historical trends, technical indicators, and economic data, traders can make informed decisions about when to buy and sell stocks, maximizing their potential returns while mitigating risks.

Monitoring stock market trends remains essential for both short-term and long-term investment success.

Common investment strategies based on market trends include value investing (buying undervalued stocks), growth investing (investing in companies with high growth potential), and income investing (investing in stocks that pay regular dividends).