As Forex market trends take center stage, this comprehensive guide delves into the intricacies of currency dynamics, empowering you with the knowledge to navigate the ever-changing landscape of global finance.

From understanding market fundamentals to mastering technical analysis, this exploration unveils the secrets of successful Forex trading, providing a roadmap to informed decision-making and maximizing your potential for profit.

Forex Market Trends

The Forex market, also known as the foreign exchange market, is the global marketplace where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion.

The Forex market is open 24 hours a day, 5 days a week, and currencies are traded in pairs. The most commonly traded currency pairs are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

The Forex market is influenced by a variety of factors, including economic data, political events, and natural disasters.

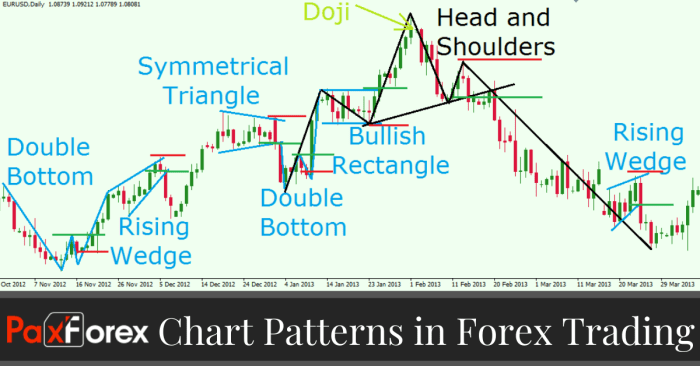

Technical Analysis

Technical analysis is a method of forecasting future price movements by studying historical price data.

The Forex market is constantly evolving, with new trends emerging all the time. It’s important to stay up-to-date on these trends in order to make informed trading decisions. One of the best ways to do this is to read the latest research from top business schools for entrepreneurs.

These schools are at the forefront of business education, and their research can provide valuable insights into the Forex market. For example, a recent study from the University of Chicago found that algorithmic trading is becoming increasingly popular among Forex traders.

This is because algorithmic trading can help traders to automate their trading strategies and make more informed decisions. If you’re interested in learning more about the Forex market, I encourage you to check out the research from top business schools for entrepreneurs.

You can find a list of these schools here: Top business schools for entrepreneurs. By staying up-to-date on the latest trends, you can make more informed trading decisions and increase your chances of success in the Forex market.

Technical analysts use a variety of indicators to identify trends, support and resistance levels, and trading opportunities.

Some of the most popular technical indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

Fundamental Analysis

Fundamental analysis is a method of forecasting future price movements by studying economic data.

Fundamental analysts use a variety of indicators to assess the health of an economy, including GDP, inflation, and unemployment.

Some of the most popular fundamental indicators include the Consumer Price Index (CPI), the Producer Price Index (PPI), and the Gross Domestic Product (GDP).

Risk Management

Risk management is essential for successful Forex trading.

Traders can use a variety of risk management strategies to protect their capital, including stop-loss orders, limit orders, and position sizing.

Traders should also be aware of the risks of leverage and margin trading.

Trading Strategies: Forex Market Trends

There are a variety of Forex trading strategies that traders can use.

Some of the most popular trading strategies include trend following, range trading, and scalping.

Traders should choose a trading strategy that suits their risk tolerance and trading style.

Market News and Events

It is important for Forex traders to keep up with market news and events.

To stay ahead in the Forex market, it’s crucial to stay abreast of market trends. Forex market analysis provides valuable insights into market behavior, helping you identify potential trading opportunities.

By understanding the latest trends, you can make informed decisions that align with the market’s direction, ultimately increasing your chances of success.

Traders can use a variety of sources to stay informed about the latest market news, including financial news websites, social media, and economic calendars.

Market news and events can have a significant impact on Forex market trends.

Epilogue

In the ever-evolving realm of Forex, staying abreast of market trends is paramount. This guide has equipped you with a solid understanding of the factors shaping currency movements, empowering you to make strategic trading decisions.

Remember, knowledge is the key to unlocking the full potential of the Forex market. Embrace continuous learning, stay informed, and let this guide be your compass as you navigate the dynamic waters of currency trading.

Understanding Forex market trends is crucial for making informed investment decisions. With the rise of mobile trading, numerous best investment apps provide real-time market data and trading capabilities.

These apps empower traders to monitor market trends and execute trades on the go, enabling them to capitalize on market fluctuations effectively.

Expert Answers

What are the major currency pairs traded in the Forex market?

The most commonly traded currency pairs include EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD.

How can technical analysis help me identify trading opportunities?

Technical analysis involves studying historical price data to identify patterns and trends that can indicate potential trading opportunities.

What is the importance of risk management in Forex trading?

Risk management is crucial as it helps protect your trading capital by setting limits on potential losses and implementing strategies to mitigate risk.