In the dynamic world of international trade and finance, Forex currency pairs play a pivotal role, facilitating seamless transactions across borders. Forex, short for foreign exchange, involves the trading of currencies, and understanding these pairs is crucial for navigating the complex financial landscape.

Forex currency pairs, denoted as XXX/YYY, represent the exchange rate between two currencies. For instance, EUR/USD indicates the value of one euro in terms of US dollars.

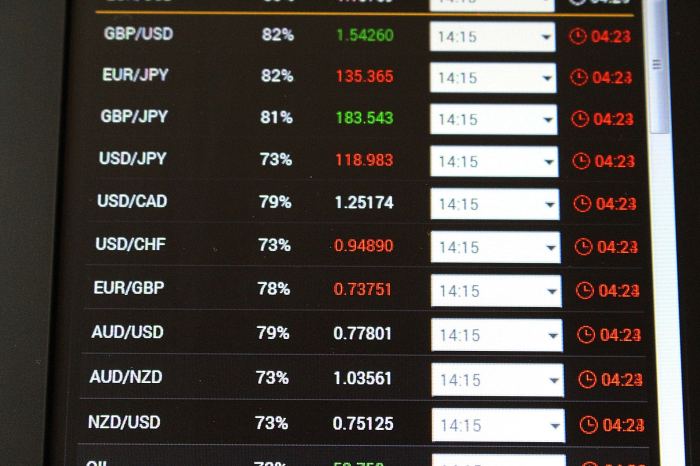

Major currency pairs, such as EUR/USD and USD/JPY, dominate the market, while minor pairs involve less commonly traded currencies.

Understanding Forex Currency Pairs

Forex currency pairs represent the exchange rate between two different currencies. They play a crucial role in international trade and finance, facilitating the exchange of goods and services across borders.

Major currency pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF, while minor currency pairs involve less commonly traded currencies.

Forex currency pairs are essential for international trade, but small businesses also need to be aware of tax implications. Small business tax tips can help you navigate the complexities of tax laws and ensure that your business is compliant.

With the right strategies, you can minimize your tax liability and maximize your profits.

Forex currency pairs remain a vital part of global commerce, and understanding their impact on your business is crucial for success.

Factors Influencing Currency Pair Movements

Economic factors such as GDP growth, inflation, and unemployment can significantly impact currency pair exchange rates. Political stability, geopolitical events, and central bank policies (interest rates, quantitative easing) also influence currency movements.

To succeed in the competitive world of Forex currency pairs, traders must possess a deep understanding of market dynamics and strategies.

To enhance their knowledge, aspiring entrepreneurs can consider pursuing an MBA from top business schools that specialize in entrepreneurship, such as Top business schools for entrepreneurs.

These programs provide a comprehensive curriculum that covers financial management, risk assessment, and innovative business practices, equipping traders with the skills necessary to navigate the complexities of Forex currency pairs.

Trading Forex Currency Pairs

Forex trading involves speculating on currency pair exchange rate movements. Strategies include scalping (short-term trades), day trading (intraday trades), and swing trading (medium-term trades).

Risks include market volatility, leverage, and the potential for losses. Technical analysis and fundamental analysis are used to make informed trading decisions.

Market Analysis for Forex Currency Pairs

| Technical Indicator | Description |

|---|---|

| Moving Averages | Trend-following indicators that smooth out price fluctuations. |

| Bollinger Bands | Volatility indicators that show the range of price movement. |

| Relative Strength Index (RSI) | Momentum indicators that measure the strength of price trends. |

Support and resistance levels indicate areas where price is likely to bounce or reverse. Chart patterns (e.g., double tops, head and shoulders) can help identify potential market trends.

When navigating the complex world of Forex currency pairs, it’s crucial to stay informed and make informed decisions. Fortunately, there’s a wealth of resources available to help you, including the latest business software for startups.

From tracking market trends to managing your finances, these tools can streamline your operations and empower you to make smarter trades.

As you delve deeper into the intricacies of Forex currency pairs, don’t forget to leverage the insights provided by Best business software for startups.

Risk Management in Forex Trading

Risk management is crucial to minimize losses in Forex trading. Stop-loss orders limit potential losses. Risk-to-reward ratios and position size should be carefully calculated.

Trading Psychology in Forex Trading: Forex Currency Pairs

Trading psychology involves managing emotions and biases that can affect trading decisions. Common biases include confirmation bias, overconfidence, and fear of missing out (FOMO). Developing a disciplined and emotionally controlled approach is essential.

Advanced Topics in Forex Trading

Currency carry trade involves borrowing a low-interest-rate currency to invest in a higher-interest-rate currency. Algorithmic trading uses computer programs to automate trading strategies.

Artificial intelligence (AI) and machine learning (ML) are emerging technologies that are being applied to Forex trading, offering potential for enhanced analysis and trading efficiency.

Wrap-Up

Delving into Forex currency pairs unveils a fascinating interplay of economic, political, and geopolitical factors that influence their movements. Whether you’re a seasoned trader or just starting to explore the world of Forex, understanding these pairs and the strategies involved in trading them can empower you to make informed decisions and potentially capitalize on market opportunities.

Clarifying Questions

What are the benefits of trading Forex currency pairs?

Forex trading offers potential for high returns, 24/7 accessibility, and the ability to hedge against currency fluctuations.

What are some common Forex trading strategies?

Scalping, day trading, and swing trading are popular strategies, each with its own time horizon and risk profile.

How can I manage risk in Forex trading?

Risk management techniques include using stop-loss orders, calculating risk-to-reward ratios, and managing position size.